401k distribution tax calculator

Using this 401k early withdrawal calculator is easy. Instead of making a 401k withdrawal before reaching 59 ½ you can decide to take a 401k loan.

401k Calculator With Employer Match Tax Savings In 2022 The Real Law Of Attraction Manifestation Methods

Tax-deferred growthSimilar to traditional IRAs or deferred annuities growth of investments with a 401k are tax-deferred which means e.

. If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or 7000. 401k Early Withdrawal Costs Calculator. Even without matching the 401k can still make financial sense because of its tax benefits.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401 k or 403 b plans among others can create a sizable tax obligation. 1-800-KEY2YOU 539-2968 Clients using a TDDTTY device. Calculate How Much it Will Cost You to Cash Out Funds Early From Your IRA or 401-k Retirement Plan 2022 Early Retirement Account Withdrawal Tax Penalty Calculator Important.

œ v 2lÂÀêù½MíîËéËMÜHm2 Þªð ao2åDˆšq9 7Ü9óûv 6 bávÂl xÒWÉ ƒ õÀ WËqÓÚœêÙØßmwìAÄÙÊÍºÍ CrÜ t0 L8äjʼw-bCÛ1Á Ù AlÔ-wÏnÅy4. Early 401k withdrawals will result in a penalty. 401k Early Withdrawal Calculator.

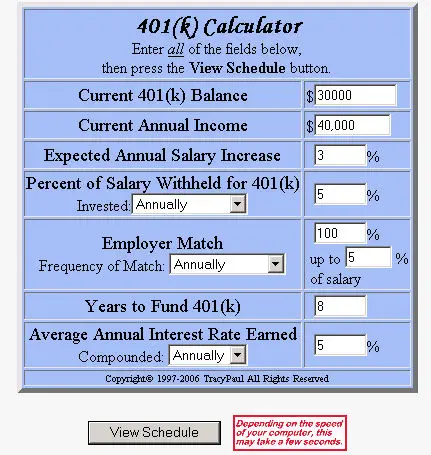

TIAA Can Help You Create A Retirement Plan For Your Future. In general contributions to retirement accounts can be made pre-tax as in. Lets go back to the 401k calculator.

A 401 k can be one of your best tools for creating a secure retirement. Her taxable income now shrinks to 4500 so her tax obligation also decreases from 1000 to. The IRS generally requires automatic withholding of 20 of a 401 k early withdrawal for taxes.

That extra 6000 basically makes the calculation a no-brainer. It provides you with two important advantages. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year.

401 k or Other Qualified Employer Sponsored Retirement Plan QRP Early Distribution Costs Calculator. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity.

Only distributions are taxed as ordinary income in retirement during which retirees most likely fall within a lower tax bracket. If I deposit a certain amount in my 401k each month what will it grow to by any future point in time. Required Minimum Distribution Calculator.

IRA minimum withdrawal calculator. Assume the 401 k in the example above is a traditional account and your income tax rate for the year you withdraw funds is 20. 401 k distribution tax form.

You can borrow up to 50 of your account balance up to a maximum of 50000. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. This calculation can determine the actual amount received if opting for an early withdrawal.

We have the SARS tax rates tables. Dont Wait To Get Started. Use this calculator to estimate how much in taxes you could owe if you take a.

Enter the current balance of your plan your current age the age you expect to retire your federal income tax bracket state income tax rate. But lets say she decides to contribute 10 or 500 of her monthly salary to her 401 k account. Traditional 401 k withdrawals are taxed at an individuals current income tax rate.

Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments. What is the financial cost of taking a. In this case your withdrawal is subject to the.

If you are under 59 12 you may also. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your. Clients using a relay service.

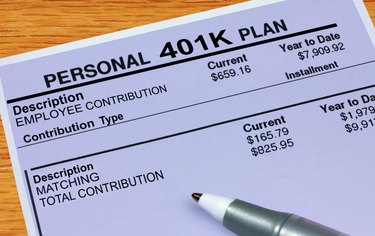

So if you withdraw the 10000 in your 401 k at age 40 you may get only. As an example we will enter 100000 as the account. When you take a distribution from your 401 k your retirement plan will send you a Form 1099-R.

Retirement planner Retirement pension planner. Please visit our 401K Calculator for more information about. First all contributions and earnings to your 401 k are tax deferred.

The tax treatment of 401 k distributions depends on the type of plan. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want.

This tax form shows how much you withdrew overall and the 20.

401k Retirement Withdrawal Calculator Clearance 50 Off Www Ingeniovirtual Com

401k Calculator With Match Online 55 Off Www Alforja Cat

Simple 401k Calculator Top Sellers 53 Off Www Ingeniovirtual Com

Tax Calculator Estimate Your Income Tax For 2022 Free

Traditional Vs Roth Ira Calculator

Retirement Calculator 401k Clearance 58 Off Www Ingeniovirtual Com

Roth Vs Traditional 401k Calculator Pensionmark

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

Free 401k Calculator For Excel Calculate Your 401k Savings

Excel 401 K Value Estimation Youtube

-savings-detailed.png)

Simple 401k Calculator Denmark Save 30 Countylinewild Com

401k Calculator

Traditional Vs Roth Ira Calculator

401k Calculator Withdrawal Shop 57 Off Www Ingeniovirtual Com

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

401k Contribution Calculator Amazon Com Appstore For Android

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps